Background

Persistence Proposal 21 allocated 1M XPRT from the Ecosystem wallet to ‘Persistence Incentivisation Multisig’ for bootstrapping XPRT liquidity in Cosmos, specifically on Dexter and Osmosis.

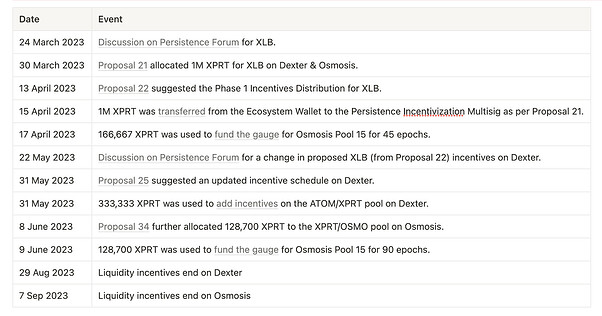

A summary of events related to XLB can be found in the image below.

As one can see, the previously added incentives on Dexter and Osmosis are ending in the coming weeks. Proposal 21 mentioned that any spending from the Persistence Incentivization Multisig will require community discussion followed by governance approval.

This forum discussion intends to share the effect of incentives to date and propose the next leg of incentives for community discussion.

Effect of Incentives

Of the 1M XPRT tokens allocated for XLB, 628,700 XPRT tokens (~62.87%) have been spent via governance approval so far. In-depth insights around the use of the incentives, their efficacy, and learnings can be found in the public XPRT Incentives Log. Here is a summary of the same:

| Pool | Incentives | Period | TVL before* | Current TVL** | % growth |

| ATOM/XPRT on Dexter | 333,333 XPRT | 90 days | ~$262k | ~$597k | ~128% |

| XPRT/OSMO on Osmosis | 295,367 XPRT | 135 days | ~$197k | ~$254k | ~29% |

*This figure is calculated by considering token prices when incentives went live

**This figure is calculated by considering current token prices

Here are some of the learnings after digging into on-chain liquidity data:

- Aggressively incentivizing on Osmosis did not translate to the expected TVL growth

- Growth in XPRT liquidity on Dexter has been quick and efficient

When the XLB discussion started in March 2023, XPRT pairs on DEXs had ~$300k liquidity. Currently that figure stands at ~$917k, a 3X increase. XPRT is back to being one of the most liquid tokens in Cosmos, thereby achieving the original goal of Proposal 21.

Proposal

The next leg of XLB incentives is proposed as follows:

- Allocate 55,000 XPRT to ATOM/XPRT on Dexter for 7-day LP bonding over 30 days, starting around 29 August 2023

- Allocate 21,000 XPRT to XPRT/OSMO (Pool #15) on Osmosis for 14-day LP bonding over 30 days, starting around 7 September 2023

Rationale

Overall

Reducing token spend

The semi-aggressive approach so far has yielded a terrific ROI in growing XPRT liquidity. This can be seen in the Effect of Incentives section above. $900k+ liquidity in XPRT pairs across Cosmos has now become a new base, facilitating efficient trading activity.

Considering the above point and keeping in mind the market conditions, it was in the best interest to find a middle ground for growing liquidity from here on and minimizing token spend as much as possible.

Striking a balance

The above-proposed incentives make providing XPRT liquidity an exciting alternative to staking XPRT (~21.7% currently). It also ensures that liquidity bootstrapping incentives are sustainable for longer periods. For further context, XPRT staking reward is expected to reduce further and settle at ~12.5% in the coming months due to the recent XPRT halving.

Testing the waters

The proposed incentives are for a 30 day period compared to the 90 day period previously. This is expected to closely track the effect of lesser token spend in uncertain market conditions on overall liquidity for more efficient incentivization in the future.

Up to this point, the daily incentive spend for XLB was 5133.7 XPRT. The newly proposed incentives amount to 2533.3 XPRT per day, a ~50% reduction in token spend aimed at withholding this newly formed liquidity base for XPRT.

Dexter

Market research of Cosmos DEXs found that Dexter offers the most favorable swap rate at current liquidity. The recent growth seen by Dexter and various new introductions such as the Tradooor Rebate Program, Persistence Community Owned Liquidity, and more have cemented Dexter’s position as the home of liquidity in the Persistence Ecosystem.

Dexter’s unique advantage of hosting liquidity of both regular tokens & liquid staked tokens is crucial in building out further LSTfi (liquid staking finance) use cases, such as borrowing/lending and vault products.

Osmosis

Osmosis remains the gateway to liquidity in the Cosmos Ecosystem. XPRT liquidity on Osmosis serves essential use cases such as XPRT exposure to other tokens in Cosmos, healthy arbitrage opportunities, IBC activity between Osmosis <> Persistence, and more.

Share your thoughts

Persisters are requested to share their feedback on the following questions:

- What do you think of the XLB progress so far?

- Do you agree with the proposed reduction in incentives and rationale behind them?

- Do you agree with the timeline of 30 days for the proposed incentives?

- Are there any additional considerations or suggestions you would like to bring up regarding this proposal?

Following the discussion, an on-chain proposal for spend from the Persistence Incentivization Multisig will be put up, taking into account relevant inputs from community members.

Everyone is encouraged to voice their opinions and contribute to XLB.