Introduction:

This post aims to kickstart a conversation and gather feedback from community members about the proposal to allocate 1M XPRT from the community pool for adding incentives on Persistence DEX and other DEXes where XPRT is present.

I encourage everyone to participate in the discussion and share their thoughts, opinions, and suggestions.

Details about previous incentivization proposal:

On August 28, 2024, the Persistence community approved Proposal #114, allocating 1,000,000 XPRT to incentivize liquidity on the Persistence DEX and other DEXs featuring XPRT pairs. These incentives have been instrumental in enhancing liquidity and volumes for multiple pools on Persistence DEX (formerly Dexter), Osmosis and Aerodrome…

As of 10 February 2025, 47,368.97 XPRT remain in the designated multisig wallet which will be clubbed along the proposed proposal and will be used for future incentivisation.

Multisig Address: persistence1xkhjn2pl7hduku2ue8f2z8atxywz4clxantaxp

Note that for security reasons, a new 2/3 multisig will be used for this proposal with the following address: persistence1fn5td7lw575xwhuyjtvearzc8p546mj6agaw0c

On avg 169,200 XPRT were spent in the last 5 months for XPRT incentives on various pools.

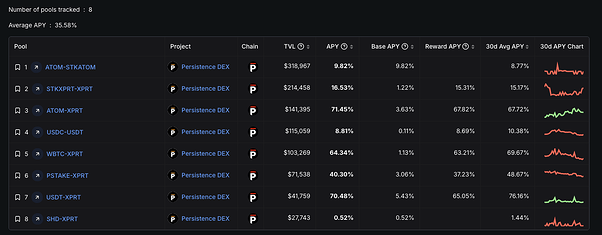

Pools Incentivised on Persistence DEX: PSTAKE/XPRT, USDC/USDT, XPRT/ATOM, USDT/XPRT, stkXPRT/XPRT, XPRT/WBTC

Pools Incentivised on other DEXes: Osmosis (OSMO/XPRT and XPRT/BTC), Aerodrome (XPRT/USDC) and Velodrome (XPRT/USDC)

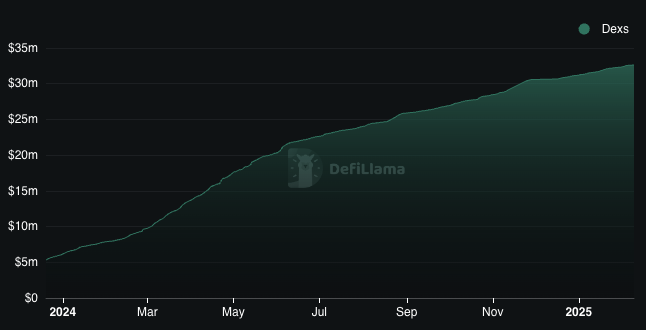

Key metrics for Persistence DEX:

During the incentives period, Total volume on Persistence DEX clocked to $32.62M

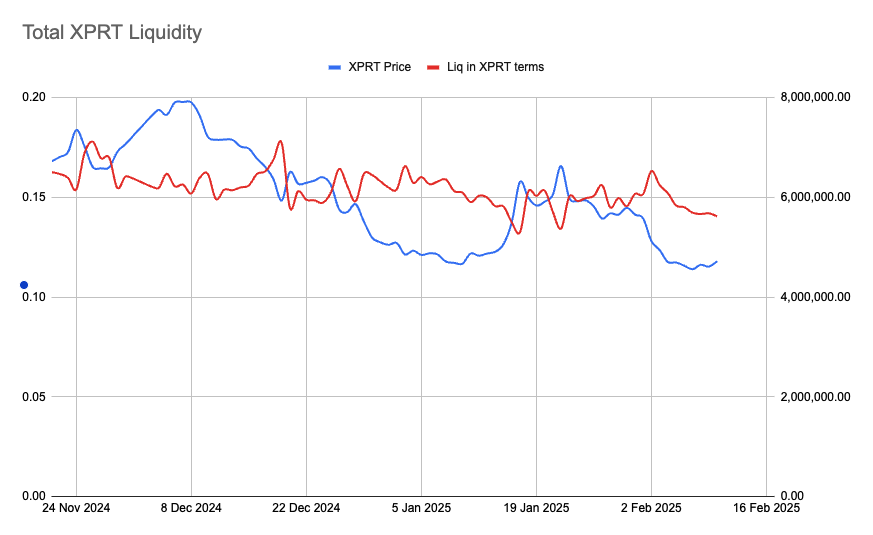

TVL declined together with the overall market, however average yields on the pools remained high enough to sustain healthy levels of TVL to support trading volume.

Distribution of the proposed 1M XPRT tokens:

These tokens will be used to maintain the incentives on Persistence DEX and other DEXs (Osmosis, Aerodrome etc) which will help maintain liquidity for XPRT.

These tokens will be used over approximately 6 months.

The incentives allocations will be reviewed every month and adjusted accordingly based on the performance of the pool. As a standard for Persistence DEX, an on-chain proposal (as below) will be created before every incentivization cycle (i.e. 1 month)

Previous Proposals for Persistence DEX XPRT Incentives:

| Month | Proposal Number | Link |

|---|---|---|

| September 2024 | 115 | Mintscan |

| October 2024 | 117 | Mintscan |

| November 2024 | 118 | Mintscan |

| December 2024 | 120 | Mintscan |

| January 2025 | 122 | Mintscan |

| February 2025 | 124 | Mintscan |

Key questions for discussion:

- Do you agree with the proposed XPRT number? If not, what do you suggest?

- Do you have any other suggestions on how to maintain / grow liquidity for the DEX?

- Are there any additional considerations you would like to bring up regarding this proposal?

We value the input and opinions of our community members, and I hope this discussion will help us better understand the needs and priorities of the Persistence ecosystem. Please share your thoughts and contribute to the conversation.

Looking forward to your insights and ideas!